Download SurgiSculpt’s free Liposuction eBook

Introduction: when is a breast lift covered by insurance

A breast lift is covered by insurance in rare cases. In most cases, breast lift surgery is considered a “lifestyle choice”, and elective, rather than a “medical necessity.” For this reason, a breast lift is not typically covered by insurance companies.

However, if you are seeking a breast lift or require a breast lift to allow for the asymmetry procedure of the contralateral breast following breast reconstruction surgery for breast cancer, then insurance will cover this surgery.

With that in mind, it should be noted that breast lifts do not cause cancer themselves. There are several stories online about patients’ breast lifts leading to positive mammography results. Thus the question of whether breast lifts can cause cancer became more common for potential breast lift patients to ask. However, you should know the answer is NO, a breast lift cannot cause cancer.

All costs can be discussed with your insurance company in the case that you would like to know clearly which procedures will be covered and which costs you would pay.

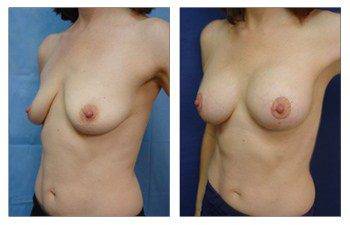

The patient’s breast lift you can see here was not covered by insurance. This case demonstrated here is a bilateral breast lift and augmentation to correct sagging breasts and a slightly lowered nipple placement.

Understanding Insurance Coverage for Breast Lift Procedures

The world of medical insurance is intricate, with various procedures falling under different categories of coverage. One such procedure that has garnered attention is the breast lift. As women age, undergo childbirth, or experience weight fluctuations, the shape and position of their breasts can change. A breast lift, or mastopexy, is a surgical procedure designed to raise and reshape sagging breasts. But does insurance cover it? Let’s delve deep into the nuances of insurance coverage for breast lift procedures.

The Rise in Popularity of Breast Lift Procedures

Over the past few decades, the demand for breast lift procedures has surged. Women are becoming more empowered to make choices about their bodies, leading to an increased interest in cosmetic and reconstructive surgeries. The American Society of Plastic Surgeons reported a significant rise in the number of breast lift procedures performed annually. This uptick can be attributed to better surgical techniques, increased awareness, and societal acceptance of plastic surgery.

Distinguishing Between Cosmetic and Reconstructive Surgery

Before we dive into insurance specifics, it’s crucial to understand the difference between cosmetic and reconstructive surgeries. The American Medical Association (AMA) provides clear definitions for both:

Cosmetic Surgery

Cosmetic surgery focuses on enhancing a patient’s appearance. The primary goal is to improve aesthetic appeal, symmetry, and proportion. These procedures are typically elective and include everything from breast augmentations and facelifts to liposuction and nose reshaping.

Reconstructive Surgery

Reconstructive surgery is performed to treat structures of the body affected by congenital defects, developmental abnormalities, trauma, infections, tumors, or disease. This type of surgery is generally done to improve function and, to a lesser degree, to approximate a normal appearance. Examples include breast reconstruction after a mastectomy, cleft lip and palate repair, and reconstructive surgery after burns.

Insurance Companies and Their Interpretations

While the AMA provides definitions, insurance companies often have their own criteria for determining coverage. These criteria can be influenced by various factors, including the patient’s health history, the specific details of their insurance plan, and the nature of the procedure itself.

The Gray Area

There’s a gray area between cosmetic and reconstructive surgeries. Some procedures, like a breast lift, can be deemed cosmetic in one context and reconstructive in another. For instance, a woman seeking a breast lift after significant weight loss might be considered for coverage if she can demonstrate medical necessity, such as chronic back pain or skin infections due to sagging breasts.

Breast Lift Surgery: Cosmetic or Reconstructive?

As mentioned earlier, breast lift surgeries are typically categorized as cosmetic. However, there are exceptions. If a woman has undergone a mastectomy due to breast cancer and seeks a breast lift as part of her breast reconstruction process, the procedure might be considered reconstructive and, therefore, covered by insurance.

Proving Medical Necessity for Plastic Surgery

To secure insurance coverage for procedures that fall in the gray area, patients must prove medical necessity. This involves a multi-step process:

Documentation

Patients must provide comprehensive documentation showcasing the medical issues related to their condition. This could include medical records, photographs, and letters from primary care physicians or specialists.

Previous Treatments

Insurance companies often require evidence that patients have sought non-surgical treatments for their issues. For instance, a woman with back pain due to large breasts might need to show that she has tried physical therapy or pain medications without success.

Consultations

Before approving coverage, insurance providers might require patients to consult with one or more plastic surgeons to assess the necessity and viability of the procedure.

Innovations in Breast Lift Procedures

Medical advancements have introduced innovative techniques in breast lift procedures. One such method is the NaturaBra™ surgical technique, pioneered by Dr. Babak moein. This procedure uses the patient’s tissue to create an internal bra, offering enhanced results with minimal scarring.

Conclusion: when is a breast lift covered by insurance

Navigating the world of medical insurance can be daunting. However, with the right information and guidance, patients can make informed decisions about breast lift procedures and potential insurance coverage. Always consult with both medical professionals and insurance providers to gain a comprehensive understanding of your options.

Please see this 39-year-old female status post bilateral breast lift and breast augmentation with moderate profile 270 cc silicone implants.